Although they are referred to as the Whiplash Reforms Programme, the new rules that are expected to be implemented in April 2020 are in fact one part of a number of measures that the Government is introducing, to make it more difficult for genuine claimants to make claims for whiplash injuries suffered in road traffic accidents (RTA). These measures will also mean that if you suffer any injury in an RTA that wasn’t your fault and the value of the claim is less than £5000, you will not be able to recover your legal costs from the insurers of the person or institution, responsible for the accident.

That might sound like the type of description that you would expect to read, from a firm of claimant personal injury solicitors, about a set of rules that are being hailed as ‘reforms.’ However, we believe that it’s important to suggest that there are alternative views to the government’s own description of these ‘reforms’, when according to the Motor Insurers Bureau website, they say that their aim is to “reduce insurance costs for ordinary motorists by tackling the continuing high number and cost of whiplash claims.”

This fixation with whiplash injury claims stems from the fact that insurance companies continue to maintain that fraudulent whiplash claims are a huge problem, without providing crystal clear evidence that they are. It certainly isn’t being very easy to find out what percentage of all whiplash claims are actually fraudulent ones.

The author of this article wrote a blog for the PI Brief Update Law Journal, back in 2017 on this very topic of fraudulent RTA claims and cited the Association of British Insurers’ own figures of 2011, which estimated that 7% of all RTA claims for that year were fraudulent claims.

Turn that on its head and 93% of all RTA claims are genuine. Even this percentage assumes that the ABI figures are correct (others think that the percentage of fraudulent claims is considerably lower).

Take into account too, the fact that since those figures of 2011, there has been a raft of other ‘reforms, which have reduced not only the numbers of fraudulent claims but equally the numbers of genuine road traffic accident claims, as well.

Are these reforms something of a ‘sledgehammer to crack a walnut’? They may well be. However, an insurance industry that has been able to get pretty much everything that it has asked for, from a more than receptive government for a period of 7 or 8 years, will always want to push for more. Reform after reform has been met with the promised of ‘lower insurance premiums for motorists. Whether anyone reading this will be able to say that they have seen any reductions in their motor insurance premiums over the past half dozen years, is a moot point.

How will these ‘reforms’ affect those who suffer whiplash injuries in RTAs?

The Government Bill which has provided the changes in the way that whiplash injury claims are to be dealt with is called the Civil Liability Act 2018. It provides for:

1. A legal definition of what a whiplash injury is.

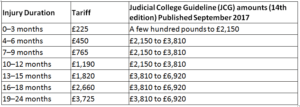

2. A tariff of fixed compensation for those injuries which are designated as whiplash injuries. The table below shows, from the left, the duration of injury, the proposed new fixed tariff and on the right, the amount of compensation that it is possible to recover as damages for the same injury, currently.

The most significant effects are to be seen in cases of whiplash injury lasting for up to 12 months. The amount of anticipated recoverable compensation has been more than halved under the new tariff.

3. A ban on offering to settle whiplash claims without there being medical evidence This was a particularly contentious practice adopted by most Insurance companies to try and tempt injured RTA claimants into settling their claim for injury compensation very soon after the accident, without gaining medical evidence. Of course, there was rarely rhyme nor reason to the amount of the offer, because no medical evidence was available at that early stage. One wonders how many people have been tempted to take the money on offer, only to find out that their injury was far more significant than they could have possibly known when the insurers’ offer was accepted?

Isn’t the Small Claims Limit being raised, too?

Yes, it is. The limit is due to be raised from the current £1000 up to £5000 for road traffic accident injury compensation. For all other types of personal injury claims, the limit is to rise to £2000. This was due to take place in April 2019 but was delayed. It is now expected to come into force in April 2020.

What is the effect of the small claims limit being raised?

For RTA personal injury claims that settle for £5000 or less and in all other cases of personal injury,, for £2000 or less, you will not be able to recover any legal costs (other than nominal fixed costs from the other party) even if you are successful. If you suffer a whiplash injury in a road traffic accident, the effects of which last for 2 years, you will not be able to recover your legal costs. A whiplash injury the symptoms of which last for 2 years, is a seriously disabling injury.

Will No Win, No Fee personal injury solicitors l stop acting for whiplash injury clients?

Very many will. At Mooneerams, we are making plans that will enable us to continue taking on road traffic accident personal injury cases valued at under £5000, when the new rules come in to play. For us, access to justice is of huge importance. Watch this space!

How will I make a claim for road traffic accident injury compensation, when the new rules come in, if I can’t get a solicitor to act for me?

The government has ordered the insurance companies, at their own cost, to build and run an online whiplash portal. This is a website where RTA whiplash claimants and those other unrepresented litigants with other RTA injury claims of less than £5000 in value, will be able to pursue their own claims, against the insurers of the driver that was at fault. Yes, that’s right. You will need to start, pursue and hopefully settle your own claim for whiplash compensation. Whether the insurers will fall over themselves to help you get the justice you deserve, without you having your own lawyer to help you, remains to be seen.

When will the ‘reforms’ come in?

Delays, delays, delays. A recent article on the Legal Futures website reported that a “growing number of insurers” believe that they will not be ready to launch the new whiplash portal in time for the April 2020 deadline.

Leading figures in the insurance industry have bemoaned the fact that there is too much to do in a period of some four months, not only to get the portal ready for consumers to use, but also to get insurance staff fully trained. One industry leader has even warned that the new portal “was in danger of becoming a white elephant.”

However, now the election is over, and the Conservative party has retained power, one roadblock to the deadline not being met has been potentially removed. Or has it? Will the government be too tied up with Brexit and all the legal wrangling that that will involve, to be interested in delivering the whiplash portal on time?

Whether delayed or not, the whiplash portal and the raised small claims personal injury limit is highly likely to come in, whether next April or later in the year.

These prove to be testing times for personal injury claimants, their solicitors and for the much-maligned principle of ‘access to justice’. Testing times, indeed